7 Essential Facts About Leasehold & Freehold in Bali’s Property Laws

Understanding the difference between Leasehold vs Freehold in Bali’s property laws is essential for anyone interested in investing or buying property on the island. These two types of ownership come with distinct legal rights, limitations, and opportunities that can significantly affect your investment’s security and profitability. This article presents 7 essential facts about Leasehold vs Freehold, providing a comprehensive and honest overview to help you make well-informed decisions in Bali’s unique real estate market.

1. Definition of Leasehold vs Freehold in Bali

In Bali, the concept of leasehold typically refers to the contractual right to use and occupy land or property for a specified period, normally ranging between 25 to 30 years, with the possibility of renewal. This means you do not own the land outright but have the legal right to utilize it for residential, commercial, or other purposes within the lease term. On the other hand, freehold ownership means full, perpetual ownership of land and buildings. The owner can freely sell, transfer, or develop the property without time limitations. In Bali’s context, freehold is mostly reserved for Indonesian citizens or legally established entities under Indonesian laws, making it less accessible to foreign investors.

2. Legal Restrictions on Freehold Ownership

A critical fact in the Leasehold vs Freehold debate in Bali is the legal restriction placed on freehold ownership. Indonesian law prohibits foreigners from holding freehold title over land, which limits their ability to have full, perpetual ownership within Bali’s property market. Foreign buyers generally must rely on leasehold agreements or alternative legal schemes such as “Hak Pakai” (right to use) or nominee arrangements that can be legally complex and risky. This limitation has cemented leasehold as a practical and legal vehicle for foreign investment in Bali real estate.

3. Leasehold Duration and Renewal Options

The duration of leasehold titles is an important factor when weighing Leasehold vs Freehold in Bali’s real estate. Leasehold agreements typically last 25 to 30 years, with options to renew the lease for additional periods. However, the renewal terms, costs, and conditions can vary widely, affecting the long-term value and security of the investment. Prospective buyers should scrutinize lease contracts thoroughly and consider the implications of an approaching lease expiration, which can influence resale value and rental income potential.

4. Benefits of Leasehold Properties

When considering Leasehold vs Freehold, leasehold properties offer several advantages, particularly for foreigners. Leasehold agreements often require lower upfront investment compared to freehold purchases, facilitating easier access to Bali’s property market. Additionally, leasehold rights are legally recognized, offering formal protection and use rights unlike informal or unregulated arrangements. This makes leasehold properties attractive for investors looking for vacation homes, attainable rental properties, or short-to-medium-term stays. Moreover, leasehold ownership can provide flexibility in portfolio diversification.

5. Advantages of Freehold Ownership

For Indonesian nationals or legally eligible entities, freehold ownership provides the most secure and comprehensive form of property rights. Freehold owners under Leasehold vs Freehold conditions enjoy permanence, full control over their property, and the freedom to transfer, lease, or develop the land without the constraints imposed by lease agreements. This security and autonomy make freehold ownership appealing for long-term investment, business development, and estate planning. It removes uncertainty related to renewals and lease expirations.

6. Risks of Leasehold Property

A major consideration in the Leasehold vs Freehold discussion is the risk profile of leasehold properties. Leasehold titles inherently carry the risk of termination or renegotiation by the landowner, which may negatively impact the investor if lease terms become unfavorable or non-renewable. Market value can also decline as lease expiration approaches, creating liquidity risks. Buyers must be aware of these legal and market uncertainties and factor them into their investment analysis. Careful legal due diligence and contract review are essential safeguards.

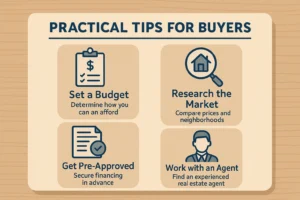

7. Practical Tips for Buyers

To navigate these complexities effectively, prospective buyers should:

- Conduct thorough due diligence on lease contracts and verify landowner credentials to avoid disputes.

- Seek reputable Indonesian notaries and legal advisors to ensure contracts comply with local laws and offer protections.

- Evaluate how lease length and renewal terms align with your investment timeline and exit strategy.

- Consider partnerships or incorporation of local Indonesian entities to explore freehold options legally where appropriate.

- Consult experts on tax implications, property registration, and inheritance issues related to leasehold vs freehold in Bali.

- Keep abreast of evolving property laws in Indonesia to safeguard your investment from regulatory changes.

For detailed legal guidance and official information, visit the Indonesian Ministry of Agrarian Affairs and Spatial Planning here and take advantage of expert insights from PureLand.

The article compares Leasehold and Freehold property ownership, highlighting key differences in legal rights, ownership duration, costs, and benefits. Leasehold grants property use for a fixed term under a lease agreement, often with restrictions and eventual reversion to the freeholder, while Freehold means full ownership of both land and building indefinitely. Understanding these distinctions helps buyers make informed decisions depending on their investment goals, financial plans, and property usage intentions.

If you want to explore more about the benefits and considerations of Freehold click here, and for detailed insights on Leasehold click here.